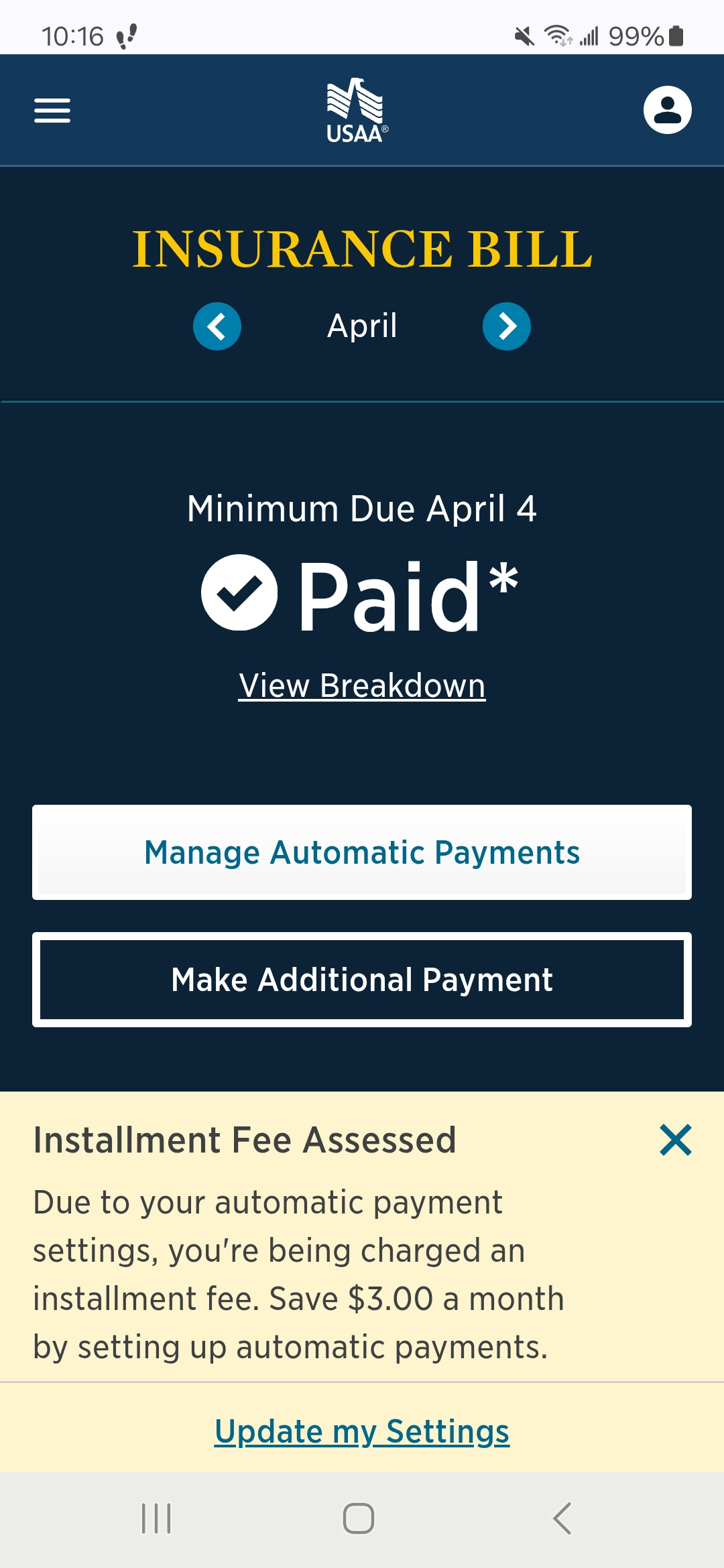

This morning, I got online to pay my insurance bill and discovered that USAA now charges an additional $3 per month to anyone who does not sign up for automatic payments. When I called to express my thoughts and feelings about such a ludicrous requirement, I was told they instituted the policy to reduce their costs in collecting payments from people who forget to pay their bills.

“It saves us from sending out multiple letters to remind them to pay their bill,” the representative told me.

What a truckload of cheap bologna. First of all, collecting payments is the cost of doing business.

Second, I’ve been late with a payment before and all I received was an e-mail telling me how long I had until they cancelled my policy. Granted, not everyone has gone paperless, but I cannot believe the majority of USAA’s customers don’t use e-mail or aren’t paying electronically. And again, collecting customers’ money is the cost of doing business.

(PRO TIP: If you’re finding more people are making incomplete payments or paying past their due dates, perhaps it’s time to look at your rates, which have skyrocketed in the last several years – even for those of us with no accidents and no tickets. Could it be that I’m now over 60?)

Yes, it’s “only” $3 a month. $36 per year. And most people will capitulate because their finances allow it. But this police hurts low-income folks, who for whatever reason, don’t feel confident to make the commitment. $36 is a wi-fi bill. Or a tank of gas. Not to mention if the company makes a mistake, which has been known to happen, the customer is responsible for overdraft fees and the time it takes to fight them to correct the mistake.

But there is a bigger issue at play here.

I expect check cashing places and companies like Aaron’s Rent-to-Own to blatantly take advantage of people with little money. But when reputable companies like USAA follow suit, it’s a harbinger of a much bigger problem.

Before you come at me with “Don’t live beyond your means” and “Learn how to manage your money better,” I’ll let you in on a little secret.

Most people who are poor know how to manage their money. Sure, there are some who spend what they have on flashy purchases that garner a lot of attention and therefore criticism; think folks buying lobster tail with food stamps. But the majority of low-income people I know hustle, work two to three jobs, go to food banks (which are losing funding), and pay their bills on time or make arrangements when they can’t.

I know because am low-income.

Then there are those who don’t have full-time jobs for a myriad of reasons. Perhaps they’re disabled. Or a caregiver. Maybe they aren’t wired to do one thing 40 hours a week (I don’t believe anyone is, but that’s a different essay). That last classification includes artists, writers, musicians. Graphic designers, digital marketers and consultants fit that category. There are no paychecks with these gigs. Often, you’re at the mercy of the client, who can take 120 days to pay. Robbing Peter to pay Paul is a way of life when you’re a gig worker.

I know because technically my neurodivergence makes me disabled and I’ve been a gig worker for over 20 years.

A lot of the comments I saw on Reddit when I searched posts about the USAA “tax” talked about suggested using a credit card to pay the bill, especially to get the points. I hate to break it to you, but there’s a good chance the folks in the two categories I just outlined don’t have credit cards with points rewards or reasonable interest rates, if they have one at all. Why?

Because not everyone has the luxury of a credit score above 700.

I know because no matter how hard I try, I can’t seem to reach that target. I was close a couple of months ago. Then I paid off the Care Credit bill I used to pay for a root canal and my score plummeted 30 points. Had I not paid it off, I would have been charged interest at nearly 30% from the time of the surgery thirteen months prior. That’s a helluva choice.

I’ve made poor financial choices in the past and have taken accountability for them, as hard as it was. Boosting my credit score past that illusive 700 – even though all my bills are paid on time and often with higher than minimum payment amounts – has proved impossible for reasons like the Care Credit situation, and I still get a half dozen offers a month from banks who send me “You’re Pre-Approved!” letters offering me a credit card. At 35% interest.

Now that USAA has jumped on the bandwagon with hundreds of other companies focused on streamlining profits at the expense of their customers, I have no hope left that capitalism won’t devour the poor and disabled like Audrey II in Little Shop of Horrors.

Until there are none of us left, I’ll keep shining the light on how polices like the new one from USAA affects the populations of which I’m a member, even if it proves to be pointless - only the proverbial hamster on the wheel running at breakneck speed and getting absolutely nowhere.

But silence isn’t an option.